The tax season is always a stressful time for individuals and businesses alike. With the recent cyber attack on a popular tax preparation software, many taxpayers are left scrambling to find alternative solutions. The implications of this cyber attack, explore alternative tax preparation options, and provide tips on safeguarding your personal information.

The Cyber Attack and Its Implications

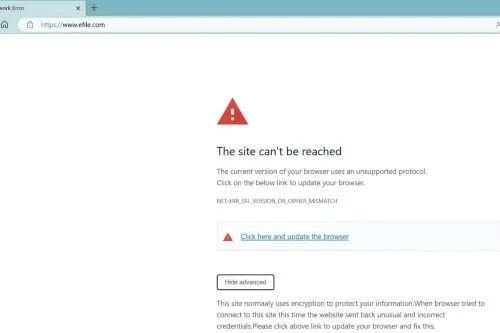

A major tax preparation software has been wiped out by hackers, leaving users with limited options to complete their tax filing. This attack highlights the vulnerabilities of digital systems and the importance of cybersecurity. Users of the compromised software must now identify alternative methods to file their taxes before the deadline and ensure their personal information is protected.

Alternative Tax Preparation Solutions

With the compromised tax software out of the picture, it’s crucial to find reliable alternatives. Here are a few tax preparation solutions to consider:

1. Professional Tax Preparers

Engaging the services of a certified public accountant (CPA) or an enrolled agent (EA) is a reliable way to ensure your taxes are filed accurately and on time. These professionals are well-versed in tax laws and can provide personalized advice based on your unique circumstances.

2. Other Tax Software Options

There are numerous tax software options available that have not been affected by the cyber attack. Some of the leading tax preparation software programs include:

- TurboTax

- H&R Block

- TaxAct

- FreeTaxUSA

Before choosing a software, ensure that it meets your specific needs and provides a secure platform for filing your taxes.

3. IRS Free File Program

The IRS Free File program is a partnership between the IRS and leading tax software providers, offering free tax preparation and filing services to eligible taxpayers. This program is ideal for individuals with an adjusted gross income (AGI) below a specified threshold, which is updated annually.

Protecting Your Personal Information

In light of the recent cyber attack, it’s more important than ever to protect your personal information. Here are some steps you can take to safeguard your data:

- Use strong, unique passwords: Create complex passwords for each account and avoid using the same password across multiple platforms.

- Enable two-factor authentication: Enable this additional layer of security for your online accounts whenever possible.

- Monitor your credit: Regularly review your credit reports for any suspicious activity or unauthorized transactions.

- Beware of phishing attempts: Be cautious of unsolicited emails, texts, or phone calls that request personal information or direct you to suspicious websites.

- Keep your software updated: Ensure that your devices and software programs are updated with the latest security patches.

Conclusion

The recent cyber attack on a popular tax preparation software has left many taxpayers searching for alternative solutions to file their taxes before the deadline. As we’ve discussed, there are several options available, including professional tax preparers, other tax software programs, and the IRS Free File program. In addition to finding a new tax preparation method, it’s critical to prioritize the protection of your personal information by implementing strong security practices. By remaining vigilant and proactive, taxpayers can navigate this tax season with confidence and ensure their sensitive data remains secure.