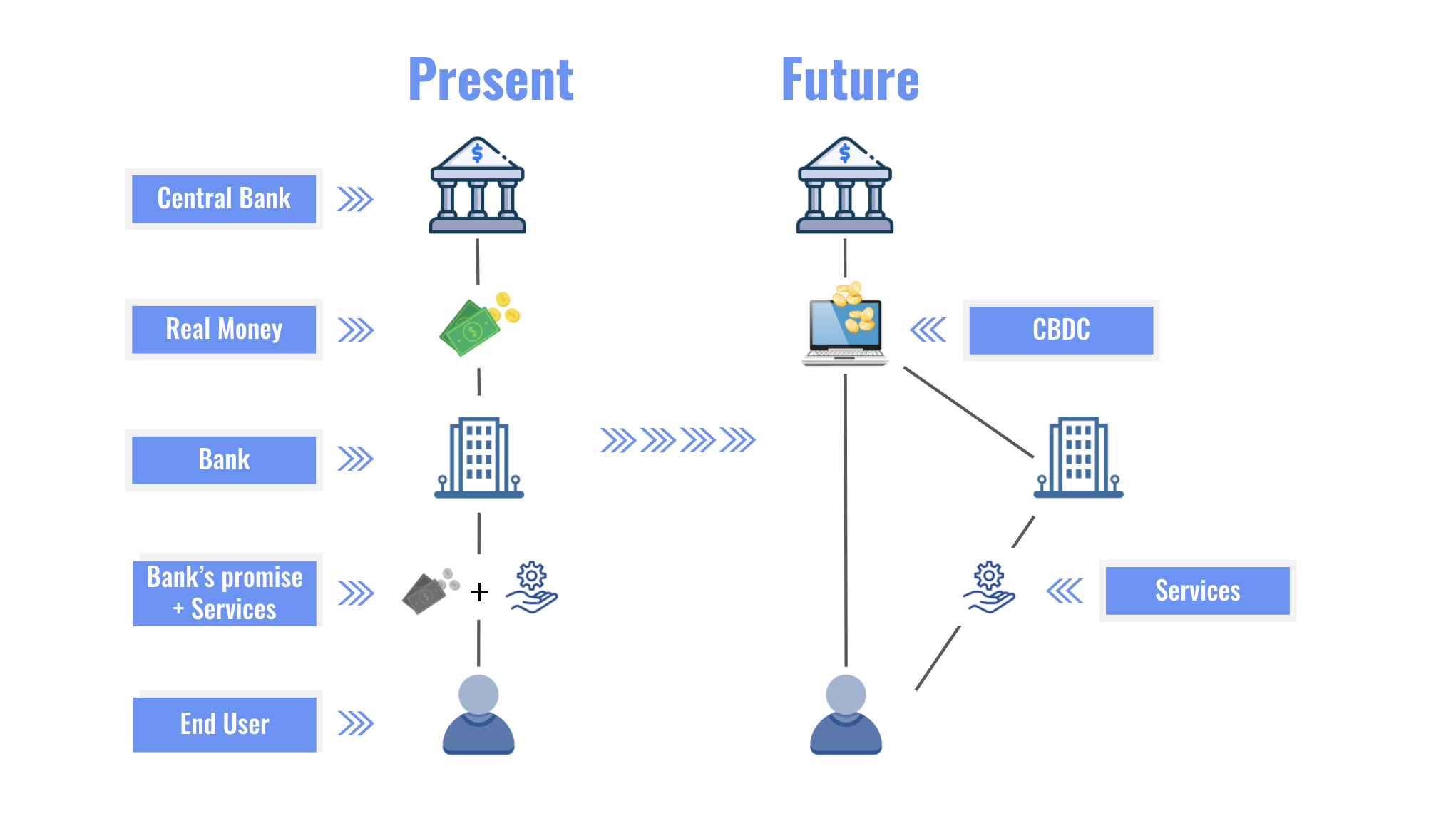

CBDCs are digital versions of fiat currencies that are issued and backed by central banks. Unlike cryptocurrencies such as Bitcoin, which are decentralized and not backed by any government, CBDCs are fully regulated by central authorities and have the same legal status as traditional currencies.

CBDCs are still a relatively new concept, with several countries exploring their potential benefits and drawbacks. China, for example, has already launched a pilot program for its digital yuan, while other countries such as Sweden, the UK, and Canada are also considering the possibility of issuing CBDCs in the near future.

How can CBDCs lower remittance costs?

One of the main advantages of CBDCs is their potential to lower remittance costs, which can be a significant burden for migrant workers and their families who rely on cross-border payments. According to a recent report by Moody’s, CBDCs could reduce the cost of remittances by up to 80% compared to traditional payment methods.

This is because CBDCs can eliminate intermediaries such as banks and payment processors, which can add significant fees to the transaction. Instead, CBDCs can facilitate direct peer-to-peer transactions between individuals, making cross-border payments faster, cheaper, and more secure.

In addition, CBDCs can also enable greater financial inclusion for unbanked and underbanked populations, who may not have access to traditional banking services. By providing a low-cost and accessible payment system, CBDCs can help promote economic development and reduce poverty in developing countries.

Challenges and considerations for CBDC adoption

While the potential benefits of CBDCs for remittance costs are clear, there are also several challenges and considerations that need to be addressed before widespread adoption can take place. These include issues such as privacy, security, and regulatory compliance, as well as technical challenges such as scalability and interoperability.

Privacy and security are particularly important considerations for CBDCs, as they involve sensitive financial data that must be protected from cyber threats and other malicious actors. Regulators will also need to ensure that CBDCs comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, while also promoting financial stability and consumer protection.

Conclusion

In summary, central bank digital currencies have the potential to revolutionize the way we make cross-border payments, by lowering remittance costs, promoting financial inclusion, and improving financial security. While there are still several challenges and considerations that need to be addressed, the future of CBDCs looks promising, and we can expect to see more countries exploring their potential benefits in the coming years.